Our tendency to fall victim to Lifestyle Inflation – spending more than we earn and taking up huge loans without really understanding what we’re signing up for – lies in the gross misconception that money and time are limitless.

While we all know we won’t live forever, we somehow seem to assume that our monthly wages are guaranteed for the rest of our careers. How long is that? Twenty years? Thirty? Forty? Who knows! Basically just a really, really long time. Such a inconceivably long time, in fact, that there’s no point really thinking about it right now.

We have a word for that, you know.

It’s called Myopia.

(Fun fact: Like many others, I happen to suffer from clinical short-sightedness (Myopia) myself. And trust me, if I didn’t have a pair of glasses resting on my face I’d be tripping over my own feet and bouncing off the walls until it killed me.)

The fundamental problem behind our financial short-sightedness which tends to completely blur our long-term vision is that we receive our life’s earnings in conveniently bite-sized monthly portions. This routine and regularity of receiving the same little lump of cash, on the same day, every single month of the year, lulls us into a dangerously false sense of comfort: We begin to believe that this stream of money will never end.

It’s okay, you think to yourself. I’ll get a fresh batch of money next month anyway.

And what’s the point of saving, right? When you know for a fact you’ll get more money next month. Might as well just put it off, I’ll save when I’m older.

To add insult to injury, our everyday brains are generally only equipped with basic arithmetic skills despite all those long years of advanced mathematics in school. When we see something we like, and it’s big, and it’s expensive, the clever businessmen on the other side of the cashier will act like any clever businessman would and kindly chop up the very expensive item into bite-sized mouthfuls – so it’s easier to swallow.

How much is this car?

And then click-clack-clickety-clack the rusty gears in your skull start to turn, and the wonderfully convenient realization dawns on you: Oh! That’s okay. That’s only a quarter of my monthly salary.

Seven years, interest payments, bla bla not important – what’s important is that the car is only 25% of my monthly salary and that’s a-okay.

But that’s very misleading.

Can you imagine if you bought a little chunk of the car at a time? This month you get a steering wheel. Next month the left side mirror. And the month after that, you’ll luck out and get yourself your first door. And after seven years of painstakingly assembling your car, you get your car key.

But that’s ridiculous.

That’s not how it works, right? You get the entire car upfront, of course! The clever businessman will give you the whole car but allow you to pay him back in little chunks, in return for something called interest.

And at the end of the loan period, you’ve coughed up the price of the car and all the interest payments in return for the clever businessman’s “kindness” without even flinching – and without even realising, truly realising just how much money and time toiling away at your work desk that you’d actually spent on your car – because you hadn’t thought about it or bothered looking back over the last seven years to reflect.

That’s how short-sightedness works. And the clever businessman is certainly not going to hand you a pair of glasses, he makes money off your disability, after all.

You need to know, how much does the car cost? No little sliced-up chunks, no sugarcoating, no fancy candy wrappers.

Chances are.. You have a car. And I’m willing to bet that you’re still paying for it. If you don’t have a car, I bet you’re thinking of getting one.

Before you sign up for any big purchase or loan, even if it’s 0% interest, even if you intend to pay cash in full for it, you need to ask yourself two questions:

- How much total money does the car cost you?

- How much total time does the car cost you?

The second question might seem confusing at first, but in fact it’s the more important one. Way back when we met Mamat, we saw how he got a job and traded in his time for money. So how much time do you have to trade in, in order to pay for your car?

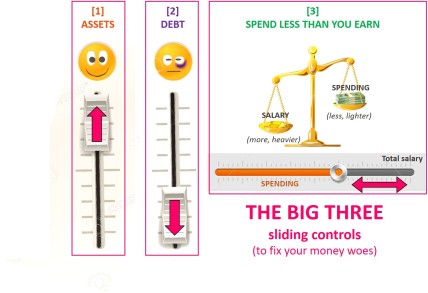

First task: Think about or, even better, write down the full cost of your car – both the principal (cost price of the car) and the interest (a percentage, over the length of your loan). If you don’t have the exact number and can’t be bothered to dig it up, that’s fine – just a rough ballpark figure will do.

Second task: How much do you earn in a year?

You’re in luck – I’ve built you a handy-dandy calculator 😀 All you need to do is click the yellow boxes, plug in your details, and everything else will automatically generate. (And don’t worry, this is just a basic calculator like one of those conversion things you get online – it won’t save or keep any of your data, and I certainly won’t be able to know who uses it and how much their salaries are hahaha):

Now that you know how much take-home pay you rake in every month and every year (with all the TAP, SCP business deducted already), how does this number fare compared to your car?

If you’re a mid-twenty millenial with a bachelor’s degree and only a few years of work experience on your back, an educated guess tells me your annual income is somewhere between the wide range of $30,000 and $50,000. If your number is higher, great! If it’s lower, don’t fret – remember, income isn’t everything.

And how much is the car you currently have, or are planning to get? Would you work an entire year with zero salary in order to be presented with that car (for free) at the end? Is your car even more expensive — does it require 1.5 years, maybe even 2 years of your time? That’s eight hours a day, five days a week, fifty two weeks in a year.

Tink about dat.

Note: Btw, I don’t have anything against buying cars per se. Like I said earlier, this applies to all spending: Think about your expenditures, especially the larger ones, in terms of how much time it’ll cost you, and don’t cut up the full cost into small pieces so it’s more palatable. You’d just be fooling yourself. And I picked cars as an example because in Brunei they’re the most common massive purchase, and they’re commonly purchased via a car loan (7 years, 4.5-5% interest I think). The worst part is these purchases (or “commitments”) are often signed up to without much thought.