In this post, I link a few articles featured on Rockstar Finance, a site that curates and posts three quick and easy articles every day from different blogs. I highly recommend it for when you’re bored and want some light leisure reading!

*bonus non-clipart, personal pix at the bottom of this post, as a reward if you make it that far

Picking up where we left off, teaching myself to be fully aware, conscious, and awake when I’m spending has allowed me to focus properly on my needs and wants – and ignore the NoisE.

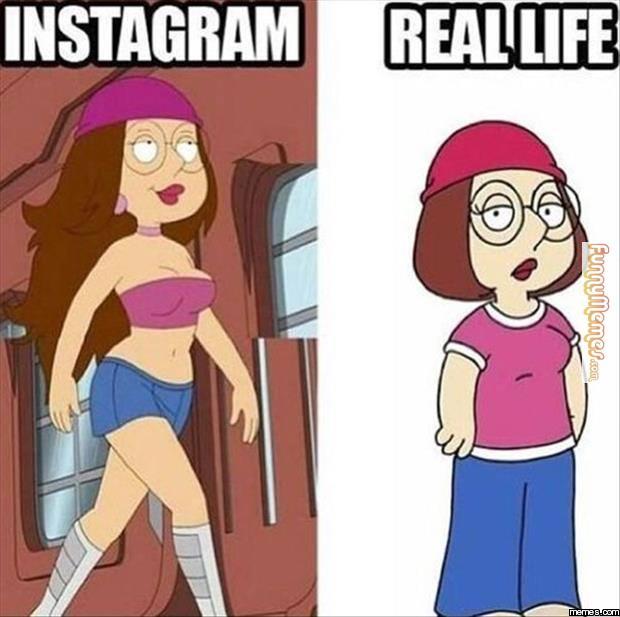

It may seem painfully obvious and trite to even mention: we’re bombarded with advertisements that convince us to part with our money every single day. Traditionally, this stuff is known to flash onto our TV screens, bounce out of magazines, and decorate the billboards we drive past on our way to work. However, the social media age has made this psychological warfare even more subtle, unrelenting, and dangerous.

Instagram, YouTube, Snapchat, Twitter, Pinterest – so many extra avenues and platforms for us to be made to feel inadequate and insecure. Our envy is no longer restricted to celebrity movie-stars and their unattainable, exclusive red carpet wardrobes anymore; the reaches of our envy have spread and multiplied indefinitely to include the “normal lives” of girl-next-door social media personalities. Regular folk – people like me and you who don’t act, sing, or dance – they have enviable beauty rooms and walk-in-wardrobes lined with shelves upon shelves of Louboutins and Jimmy Choos; they’re buying all the new Tarte Cosmetics, Urban Decay make-up palettes, all the new hijabs, limited edition build-your-own charm bracelets, up-and-coming local and regional designer wear. And look at how pretty/happy/successful all these normal people are! How can I be more like that?

Unfortunately, social media platforms have blurred the lines between reality and fiction so much more, and in so many ways. For one, it’s harder than ever to be able to identify between what a person truly believes and what a person is paid to say. Beauty vloggers on YouTube review the latest must-have make-up and lifestyle items every month (that they’ve perhaps been sent or paid sponsorship fees for), fanning the flames of temptation within your weak consumerist heart. Old products are repackaged, rebranded, and renamed so they’re “new” again. Highlighting your face? No, no, it’s called ~strobing~ now. Your old lip liners are redundant and obsolete, you need lip contours; they’re better and cooler even if they’re essentially the same product.

How many beverage containers and bottles does a person need in their life? Hydroflasks, Starbucks tumblers, KeepCups, bottles with built-in diffusers for natural fruit-flavoured water, time-stamp markings to ensure you’re drinking enough throughout the day. And oh man, don’t get me started on personalized items. One way to get a sucker to buy something is if you tell them you can put their name on it. Keychains, phone casings, passport covers, notebooks – One foolproof way to get someone to buy a notebook they’ll never, ever use is to make it out of something unique like organic recycled paper, and then emboss their name onto the cover. I’ve been known to be that sucker myself so I know what I’m talking about.

Now, I’m not being a hater. Just like everyone else, I’ve also fallen victim to these temptations. (I have my name carved out of wood, embossed on a laptop bag, and forged into a necklace… In case I forget what my name is, you know.) This just brings us back to the conversation about exercising spending awareness and prioritizing our needs above wants, and doing away with the “stupid little accidental purchases” that we don’t consciously think about, and simply sucker ourselves into buying because Parkinson’s Law rightfully predicts that we’ll just use up our money because it’s there.

I highly, highly recommend reading this piece by Mark Manson about how your insecurity is bought and sold, here’s an extract:

Oftentimes, the marketing in our economy pushes insecurity onto us that is not helpful and that intentionally triggers inadequacies or addictions within ourselves to make more profit.

… it also becomes economical to feed into everyone’s insecurities, their vices and vulnerabilities, to promote their worst fears and constantly remind them of their shortcomings and failures. It becomes profitable to set new and unrealistic standards, to generate a culture of comparison and inferiority. Because people who constantly feel inferior make the best customers.

!!

We essentially share the same conclusion to all of this too; he says:

Some may argue that this sort of stuff should be regulated and controlled by government. Maybe that can help a little bit. But it doesn’t strike me as a good long-term solution.

The only real long-term solution is for people to develop enough self-awareness to understand when mass media is prodding at their weaknesses and vulnerabilities and to make conscious decisions in the face of those fears.

Okay now go read it yourself, it’s good I promise 🙂 Here’s the link again.

Our needs are (or should be) quite straight-forward, and must be stripped down to the bare minimum. The obvious things like food (the necessary building blocks of mealtimes: rice, eggs, cooking oil, meat, veggie), toiletries, a decent set of clothing, basic car, school funds, etc. In Brunei, I’d estimate that these basic, fundamental needs would be easily fulfilled with a few hundred dollars a month, if you’re a single person.

The minimum wage or poverty line is usually a good indicator of how much a person or family requires to meet basic necessities. Stay-at-home Mom Economics (Bruneian!) estimates that the minimum living wage for a family of four is BND 1,180. Roughly dividing this value would indicate that a single person could potentially fulfill their basic needs with about $300 per month. (This is just a crude indicative estimate.)

But essentially, beyond your basic needs – worth that few hundred bucks a month – most of the things we spend on are our “lifestyle choices” or wants. And as we talked about earlier, the cacophony (bombastic word of the day) can be so overwhelming that it’s difficult to disentangle your actual wants from:

- the crap you accidentally buy because it’s convenient, like the candy bars by the supermarket cashier

- the crap you buy because everyone’s got one and you have FOMO (fear of missing out)

- the crap the Clever Businessmen convince you that you need and want even if you really didn’t need or want something like that until you’d heard about it. Wake up sweetie, stuff isn’t simply created just to satisfy existing needs; needs are also created so people can sell more stuff. A Hydroflask is a good example: did you really need a drink to stay boiling hot for 24 hours? Do you even want a drink to stay that hot for 24 hours?! Or is it just a “cool thing to have” that’s so revolutionary and fantastical that you suddenly can’t not have one. Like a laptop tray for your lap with built-in cup holder. Or Siri.

Capitalism, consumerism, and the insecurities associated with keeping up with the Joneses (or Kardashians) will make you want things you didn’t really want before; or at least they’ll temporarily fool you into thinking you want things that you truly don’t… And then regret shortly after buying.

So how do you prioritize and really, truly know what your wants are; there’s so much to spend on, it’s so easy to think I want everything it’s impossible to trim down my list!

I suppose I could tell you to just set a budget and buy whatever wants fit into that budget and nothing more. But personally, I think that’s a rubbish, unrealistic organizing principle which would never really work. And it’s not helpful, because even if you did set a budget (which is important) once your needs are taken care of, how do you know which specific stuff to prioritize and spend on?

Spend on happy. Put your money where your happy is.

This post on how to save money without hating your life sums it up really well, so go take a break from my monologue and read it quickly. I swear it’s a short and sweet read (not like my rambling which goes on forever, amairait.)

The NoisE leads us to spend on things that we think we should, or we think people our age, our income-level, our social class should. You know what I’m talking about. In Brunei, buying (on a seven-year loan) a brand new, preferable European, car is a MUST(!) once you’ve secured a stable job. As a working professional, you sort of need at least one great designer bag or an expensive watch to fit in with the corporate crowd. Refined ladies get a professional mani-pedi once a month, and get their hair treated and steamed on a regular basis. God forbid buying Nivea now that you can afford L’Occitane.

But if you really think about it and exercise that awareness we’ve been talking about, do you really get a kick out of these deluxe expenditures or do you just spend on them because you think you should? Do these things make you happy, truly?

I’ve been working for a few years now and I realized pretty early on that I didn’t need or want a new car.

I don’t need a new car because there’s a spare car lying around at home which nobody uses. And I knew I didn’t want a new car because, well frankly, cars aren’t my thing. I’ve never had a dream car, and I don’t particularly enjoy the full experience of owning my own car: sending it for servicing and getting the road tax renewed is a big pain in my bumhole; I don’t understand things like fancy tyres and rims and getting the car waxed and polished. To me, a car is a vehicle that will get me from Point A to Point B and that’s enough to keep me content.

Sure, loads of people have raised their eyebrows at this apparently controversial lifestyle choice and probably think I’m a total cheapskate. But well… I’m not going to lose half my paycheck to peer pressure, sorry not sorry. I don’t need a car, I don’t want a car, and cars don’t make me happy, it’s as simple as that. And the bills and payments associated with a new car definitely wouldn’t make me any happier. This is general motivational-Tumblr advice: don’t sacrifice your own self-worth or hard-earned money trying to impress people or fit in! Especially if you don’t gain any discernible amount of happiness from it. You can’t ever gain happiness from trying to impress people, and people never stay impressed for very long. Just think about it, six years ago the iPad was incredibly awe-inspiring but now it’s just a piece of meh.

If you have a nice car and you love it and it makes you happy and you can actually afford it (i.e. you’re not financially screwing yourself over by owning it) – then good for you, yay! But the same can’t be said for myself.

A nice new car wouldn’t make me happy. Manicures don’t make me happy. Expensive soap and shampoo don’t make me happy. Getting my hair done doesn’t make me happy. Designer bags and clothing, surprise surprise, also don’t make me very happy.

Am I a cheapskate?

Well… I don’t think so.

Pictures are literally just screenshots of my Instagram feed. Yes, this is my personal collection which I photographed myself (on an iPhone). Hover or click for details on where and when 🙂 This is just a little snapshot of some of the places I’ve been in the last few years so you get an idea of… Well, what do I spend on? What makes me happy enough to make me want to part with my money?

Travel makes me very happy 🙂

Sure, sure, everyone says they’re a wanderlust, nomad, globe-trotter; spend on experiences, not things; the world is a book and those who don’t travel only read one page, etc. etc. These inspirational quotes mean well – and I do personally think travel can be one of the most enriching experiences the world has to offer – but be careful, be wary and really think about what does make you actually happy.

Travel can so easily be one of those things that people do because “everyone else does it”. It’s a shame when people may not truly enjoy the full experience of travelling (maybe it’s tiring, they have young children and it’s expensive or it’s a hassle, or they’re more comfortable staying at home; there are a variety of reasons), and perhaps only do it so they can take nice pictures for their Instagram feeds and fit in with the other global citizens who take it upon themselves to backpack across Asia and Europe in search for enlightenment. And there’s nothing fundamentally wrong with any of that, if it makes you happy then great!

But if it doesn’t make you genuinely happy, or you’re only doing it for the selfies and Instagram-worthy posts, then is it really something you want to spend your money on? Turn on your spidey-sense, exercise spending awareness, and consciously ask yourself – does travel excite you, make you happy, fulfill you, make your life better? Is the money spent on it money well-spent? Or do you not get that big a kick out of it and find yourself repeatedly underwhelmed and disappointed but, hey, at least you’ve got pictures and souvenirs to bring home.

Have a good think, especially when your spending decisions come with a big price tag attached. This is certainly not limited to travel, that’s just an example I’ve used. I’m talking about anything and everything. Do you need it? Do you want it? Are you sure you want it? Does it or would it make you happy? Are you suree? What makes you happy?

Travel has always been a big part of my life. I was fortunate enough to have had the privilege to travel a bit as a child, and once I left for Uni as a teenager, I saved up my allowances and used literally every free reading week and semester break to (budget) travel with my friends. And at the risk of sounding like a huge hipster, this was way before Instagram okay hahaha. Now that I’ve started work and have a limited number of leave days, I try to have at least one big holiday a year.

Travel makes me happy, and I put my money where my happy is.

On a day-to-day basis, I spend quite a bit on eating out (half my expenses), and that’s because food makes me happy and socializing with friends over mealtimes makes me happy. Coffee makes me happy, and quite an extravagant amount goes into sustaining that type of happy (a little too much tbh, I’m trying to cut down and manage that habit better.) A full-body massage at least once a month makes me happy. My pets make me happy. And like most people, occasionally shopping for new clothing and shoes does make me happy too – but it’s not the highest on my list of happy-makers.

I don’t do any of the things I mentioned above because I think it’s socially expected of me; I think I’ve made it pretty clear that I don’t give a rats ass what material goods and lifestyle services I’m expected to spend on. I spend on things I need, things I want, and things that make me genuinely happy, and improve my state of mind and quality of life.

What specific things these are differ from person to person, and it’s worth remembering that. If you’re really into photography and that makes you truly happy and at ease with yourself, then perhaps you’d want to spend money on cameras and tripods and lenses and general photography gear. If your passion lies in make-up, then spend your money on your beauty kit. If you’re a gamer, an expensive gaming console may make you happy.

No matter what it is, it’s paramount to still keep to the basic principles of smart personal finance: have a budget, don’t spend more than you make, avoid debt as much as possible, and ensure you consistently build your savings. Plan your budgets wisely, take care of your needs first and then leave some room to spend on your wants, but because humans are insatiable creatures with unlimited nafsu… Filter your list according to what makes you happiest, and weed out the “crap stuff” the Clever Businessmen are trying to make you think you want.

Remember, you can afford anything but you can’t afford everything.