Update: Extra stuff at the bottom cos I’m pedantic and edit my notes a lot.

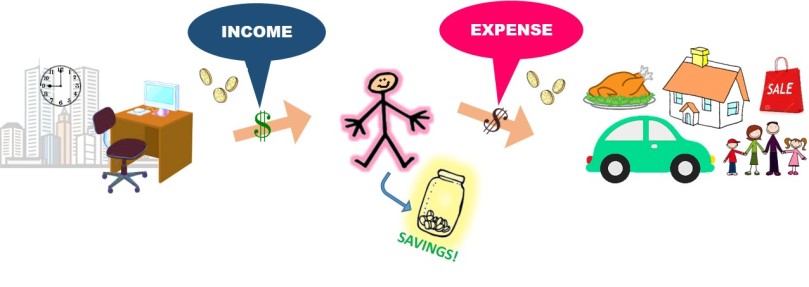

In Part I of the Muney series, we met Mamat – that regular Joe (or Jane) that we’re all too familiar with. He has a slew of needs and wants, both material and non-material, which must be satisfied in order for him to go about living a comfortable and fulfilled life. In this world, that almost certainly means he needs money to pay for all this. And as any regular Joe (or Jane) without a large family inheritance would do, Mamat gets a job which will provide him with income, which he will then spend on need-and-want-related expenses.

One thing we haven’t got around to talking about in Muney is that little golden savings pot near Mamat’s left foot.

I don’t need to really tell you that savings is important, right? We grow up knowing that it’s important to save; it’s sort of the standard Beauty Pageant answer (world peace!) to “What would you do if you won a million dollars?!“, after you buy a house, give some to your parents, donate to charity, and the all-too-vague “invest the rest, i guess“.

We all know what it’s like to “save up” for planned expenses. This could be an expensive shopping want like a designer bag (saja, or as a birthday gift to yourself, or as a reward for getting a promotion, whatever excuse you want to give yourself really). Or it may be a big life expense like a self-funded university course, a wedding, a new baby, a seven-seat van for your growing family, etc.

But even if you’re not specifically saving up for a particular planned expense, a healthy savings pot is important as an emergency cushion (a form of self-insurance from life’s inconvenient and sometimes tragic surprises), both for yourself and your family and dependents. Even if you’re still single now, it’s always wise to gain traction and start early to make life that little bit easier for your future (and probably overburdened, sleep deprived) self.

So let’s go back to Mamat. He’s got the job, the income, he has a little savings pot, and he has his expenses. And that’s how the game starts, yes?

Now, let’s fast-forward five years.

Here’s Mamat again, only five years older:

He’s got a bigger desk at work, which means even bigger bucks are rolling in, so he’s able to step up his game: fancied up his house, bought a sleek new ride, takes his family out to eat at fancy restaurants, and decorated his wife with shiny rocks.

There’s no harm in that, right? After all the years of pinching pennies and shopping Hua Ho Bonus, you deserve 4-ply dolphin-stamped toilet paper. After all those years of Forever 21 and H&M, buying all those faux leather handbags that came wrapped in plastic and peeled like sunburnt skin after a couple of months, you deserve a proper bag. And now that you have a proper bag, you need a proper wallet (to match, of course!). If after a year your insensibly cream-coloured Prada wallet is now dirty – gosh darn, time to get a new one. After all, these things are investments, aren’t they? (Link spoiler alert: Usually no.)

Unfortunately, earning your own income and making money makes us vulnerable to this powerful, invisible force called Lifestyle Inflation. It starts small and undetected, like a cancer, and then it grows and spreads silently. Suddenly, everything you own looks old and gross and could use an upgrade; everything that was once way too expensive and unnecessary in your former, less-moneyballin’ life you’ll suddenly really, really need (!1!). It might seem ridiculous to you now, but if you had the money or financing – you’ll find a way to need a private yacht. Especially if all your friends had yachts too.

The more you earn, the more you spend – and your lifestyle inflates like a balloon, swallowing up your money under the guise of “necessary expense”.

Looking back and comparing Before Mamat with After Mamat, we can see that he’s been bitten by this Lifestyle Inflation bug; the more income he earns, the more expenses he has eating away at this money – and his savings pot stays exactly the same. Unfortunately the reality is that some people get so fixated with the material lifestyle and keeping up with the Joneses that they actually put themselves in even worse financial situations once their incomes increase. Isn’t it ironic.

Now listen to mama myn:

Wealth is how much you keep not how much you spend.

Don’t go broke trying to look rich.

Did you know that around 70% of lottery winners lose all their money and basically go bankrupt within about five years of their big multi-million dollar windfall? And when asked how happy they are within one year of winning the lottery, winners don’t feel any happier than someone who suffered from loss of limb due to a tragic accident. (The study showed that most people have a set level of happiness and that even after life-changing events, people tend to return to that set point.)

Still think that winning the lottery will change your life for the better? Hao about no.

Lifestyle Inflation is a big deal, and it’s important to be aware of this, and realize that you and I are just as vulnerable (and are probably already a victim of it) as anybody else. Allowing your lifestyle to inflate at the same rate, or god forbid FAsTeR, than your income growth will severely jeopardize not only your financial health right now, but the financial health of your future self too. One major red flag is if you’re neck-deep in debt; credit card debt, car loan, house mortgage, personal financing.

You get into debt when your present self can’t afford to pay for stuff, and what debt does is that it simply pushes the responsibility of payment to your Future Self – and then slaps on an interest rate in return for the delay-favour. In essence, debt is really just a punishment for your Future Self that you sign up for right now.

Would you want a hundred slaps on your face today, or a slap a day for the next six months?

What if you have a cheekful of volcanic pimples next week? HOBOY, DAS GUNNA HURT REAL BAD. But pffft, whatever right? Future You can deal with that.

It’s the same thing with debt, really. We sign up for debt today without giving much thought to what sort of situation we’ll be in one year from now, two, three, seven years. Sure, a $500 monthly payment won’t hurt this month. But how do you know you won’t desperately need that money in a year? Do we think about this, do we factor in this risk?

Okay sorry off on a tangential rant, we’re not supposed to talk about debt today.

Our lifestyles will naturally inflate to some degree, of course, especially if you start talking about the Big Adult Stuff like starting a family and buying your own home. Baby milk, das espensif.

But avoiding unmitigated Lifestyle Inflation is a key tenet in ensuring good financial health.

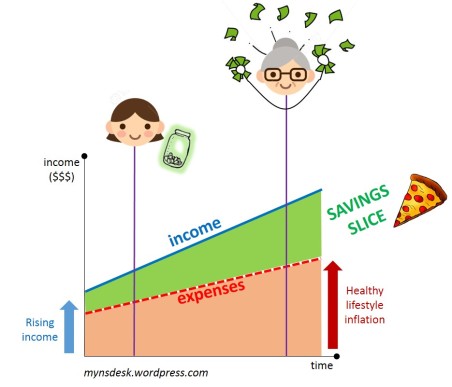

The ideal, financially healthy Mamat looks more like this. After five years of working, he earns a fair bit more money than he used to. And instead of a vroom vroom sports car, he’s invested in a decent, reliable model (still a great car, but maybe not as exclusive or awe-inspiring), a comfortable home, no swimming pool or crystal chandelier, but enough rooms and a solid roof to place over his growing family. In the meantime, he’s disciplined with his savings and continues to squirrel away a percentage of his income into a savings account with competitive interest rates. He realizes that money is a powerful tool, and so keeps his emergency cushion well-stocked, next to his other little savings pots – for his next family holiday, his children’s education fund, and eventual retirement.

Financially healthy Mamat doesn’t keep up with the Joneses.

Financially healthy Mamat spends less than he earns.

Financially healthy Mamat is a clever guy.

Be more like Financially healthy Mamat.

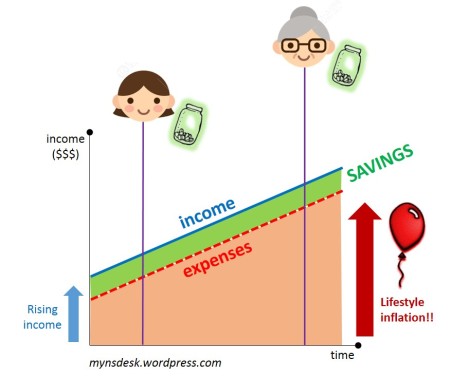

In case my clipart friends haven’t been able to convince you enough, here are a couple of charts for you graph nerds.

So here’s a chart of income against time, and the blue line shows how your income rises the more time passes: you get salary increments, promotions, move to a higher paying job, etc. generally gaji ani naik right, over the years? The rather alarming red dotted line beneath it is your expenses – and unchecked lifestyle inflation means your bills can grow just as fast as your income (and sometimes even faster).

So due to this lifestyle inflation bug, rising expenses completely cancels out whatever salary increment you get… And your savings (if any) stays the same old boring plank over the next ten, twenty, thirty years until you’re old and aching and moaning about how you wish you could retire but oatmeal is so expensive at Supasave.

Here’s the Financially Healthy Mamat version:

Aim for the pizza slice and eat all the Supasave oatmeal your future grandmotherey self will desire.

[…] impressed I remember enough of my blog posts to be able to link stuff haha but here, go read up on lifestyle inflation. I even did custom clipart for it, that’s how invested I […]

LikeLike