(Updated to include TAIB & Baiduri’s Multi-Tier offerings!)

A number of people have asked me which banks I use, where I keep my savings, do I have a debit card? A credit card? Is one savings account enough? Should you have accounts with more than one bank?

So let’s start talking about bank deposits and some of the different accounts available.

First of all, I think it’s important to draw the line between a general use account and a savings account.

A general use account is also known as a current account (in the UK) or a checking account (in the US). This is just a regular, ordinary, general whatever account where your salary/paycheck gets dropped in every month, and you can withdraw cash freely with no issues or restriction. It’s quite common to have a debit card attached to this type of account so you can access your funds more conveniently. So a general use account is essentially just a digital wallet: easy in, easy out. The primary benefits are safety and convenience, but interest rates are usually very low so you won’t get much return (or profit) from them – especially because your account balance tends to bounce up and down.

A savings account, on the other hand, should actually be very different. I say should because based on some of my conversations, a lot of people see their general use accounts as their savings accounts too – they’re the “same thing”, and it’s just ONE mega account with both purposes lumped together.

But this isn’t an efficient way to do it at all.

A savings account should hold money that is much less accessible and not easy to spend. Since you’re saving for something (logically in the future, either short-, medium- or long-term; or your emergency fund) you should minimize the chances of “accidentally” overcharging your debit card and wiping all your savings out. It’s also harder to track and make sure you’re saving (and making sure your balance increases) if your account keeps fluctuating and bouncing up and down every time your salary comes in and your monthly spending money goes out.

It’s best to keep all the volatility confined to one account – the general use account – and have your savings sitting separately, somewhere much quieter and safer, where it has space to grow and you can actually monitor the growth without all the spending and over-activity being a distraction. Space to grow – that’s another important reason why savings accounts should be separate.

Savings accounts generally offer higher interest rates, and more opportunity for profit and return. We’re not talking get-rich-quick levels (as if there is such a thing!) but every little bit counts. I mean, if your money is going to just sit around and do nothing anyway, you might as well put it somewhere it can grow just a tiny bit bigger, a tiny bit faster. Since savings accounts are designed for savings, and not up-down-and-around general usage, there are some restrictions on withdrawals in order to benefit from the higher interest rate. For example, if you withdraw cash on a certain month, you may not get the profit for that month. But for every month you refrain from taking money out, you’ll benefit from the higher interest rate.

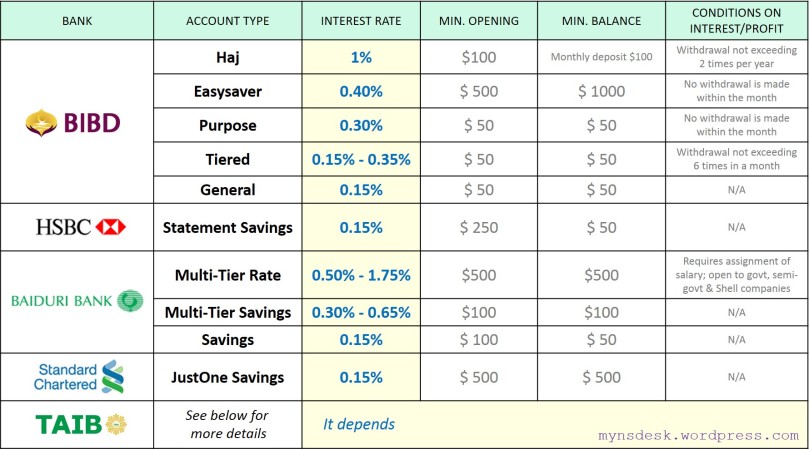

Since I’m such a good friend, I put together this helpful comparison of the most common accounts available in Brunei. A word of caution though – the interest rates offered in Brunei are pretty pathetic, but oh well!

The list above represents (in my opinion) the most commonly used banks in Brunei for general usage. Each bank will offer a default account for general usage (i.e. BIBD general, HSBC Statement Savings, Baiduri Savings, SCB JustOne Savings) when you open up a new account – and they all earn a teeny-tiny 0.15% interest.

The specific way the interest is calculated varies across banks, but as a general rule it’s a per annum rate, but divided across 12 months. So a rule of thumb is apply the interest rate to your end-of-month balance, and that’s what you might earn for that month. Just to clarify, a 0.15% rate is NOT 1.5% or 15%; it’s 0.15 of a percent! So when I say tiny I mean tiny. If you check your bank statement, chances are you only earn a few cents a month.

This rate is fine for a general use account. But like I said earlier, if you’re trying to save up and your money is just chilling out doing nothing for a while, you might as well put it somewhere it can earn just a little bit more!

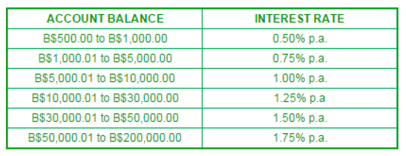

The Tiered accounts (i.e. BIBD Tiered, Baiduri Multi-Tier Savings & Multi-Tier Rate) offer varying interest rates, depending on the amount of money in the account. The idea is the higher the balance, the higher the interest rate.

BIBD Tiered and Baiduri Multi-Tier are similar, but Baiduri offers comparitively better rates (in exchange for a higher minimum deposit and balance). BIBD doesn’t give details on the site, here are the Baiduri tiers:

If you already bank with Baiduri, or are willing to move your salary over, you could sign up for the Multi-Tier Rate Account, which has even better rates. The fine print is you have to have your paycheck assigned to the bank, and be a government, semi-government, or Shell-linked employee. But I have a feeling you could just give it a shot and try your luck even if you don’t meet the employment conditions; maybe they don’t really check?

As you can see, simply upgrading your account or opening a new one (with a better interest rate) can easily give you more than double the default general accounts in all the other banks. It’s not winning the lottery but it’s still better than nothing, no?

If you had $1,000 in a general use account, you’d only get $1.50 a year. In a BIBD Easysaver (0.4%), that could be $4 a year. Sure, sure – peanuts right, so sekadar, luan jua kan bekira! But if you had $10,000, that would be a $15 vs $40. Still nothing, perhaps. But if you’re already an existing BIBD customer, it’ll take you literally ten minutes to open up a new account online, move your money, and then forget about it forever (until you need it). And transfers within the bank are free, and easy to do online. I’m sure the same applies to most of the other banks too. If you want to withdraw, that’s fine! Withdraw pulang. You only lose out on the interest for one month. Jangan saja withdraw every month, using it as frequently as you would a general use account would defeat the purpose.

At the end of the day, you might be thinking – it’s such a small difference, malas ku eh. But what if your employer asked you one day, hey buddy do you want a random, mini-salary raise of $4? Instead of, say, $2,000 per month I’ll give you $2,004 starting from today. You’d probably roll your eyes and think oh wow how generous, but you wouldn’t reject it and be like nah keep it – would you? And the tiny little increases have an important compounding effect (which we can talk about another time) so don’t be too quick to scoff.

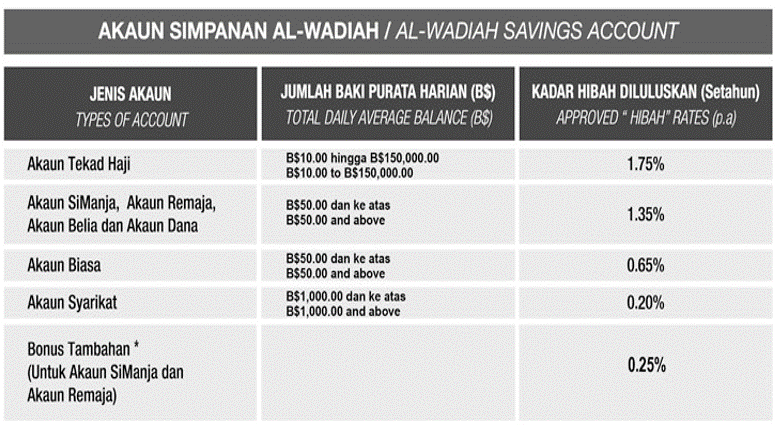

TAIB is an outlier in the sense that it appears to operate on a strictly profit-sharing mechanism and doesn’t guarantee an interest/profit rate, unlike the rest of the banks on the list. Nevertheless, they do have great offerings, which appear to rival the rest:

Based on the information I could find on the site, the first account (Tekad Haji) is specific for Haj savings purposes while the second row (SiManja, Remaja, Belia, etc.) are age-specific accounts, e.g. Belia are for individuals between 22-30 years of age. I assume the default general-use account is the Biasa (normal) one, and it did very well at 0.65%. The approved profit-sharing rates shown in the table are based on 2015, and “the rates for ensuing years are subject to TAIB’s financial performance.”

So I suppose the trade-off for the higher potential interest rates is the risk is that these profits aren’t guaranteed – unlike BIBD which does guarantee a set profit rate under the umbrella of syariah-compliant banking.

Unfortunately, TAIB doesn’t have a great website so if you’re looking for more details, your best bet is to schedule a branch visit. The impression I get is that they’re not as commercial, consumer-bank-oriented as the other four – they seem to provide ATM cards, but no debit cards, limited cards rewards programs, and they don’t advertise or hold promotions/offers as much as the other banks.

The only two other banks in Brunei which I haven’t mentioned are Maybank and RHB (both Malaysian banks) because they don’t have any information online beyond a “Brunei presence” page on their group websites. If you have any information with regards to their account offerings and interest rates, please let me know!

** Update: The RHB savings account also earns 0.15% interest!

On a final note – The BIBD Haj account (1% interest rate) and the TAIB Tekad Haji are accounts specifically for Haj/Umrah purposes and not just, y’know, saving up for a wedding or a Eurotrip. I guess you could just open up a Haj account at either one of these banks in order to take advantage of the best interest rates – I’m sure they don’t police you and track exactly what you use the money for – but that depends on where you draw your own ethical, moral line. I personally wouldn’t be comfortable using those accounts for non-Haj/Umrah purposes but that’s just my own preference.

Which bank(s) do you hold an account with? Do you know what your interest rates are?

This blog is a jem!

LikeLiked by 1 person

That’s very kind, thank you! Glad you’ve enjoyed 🙂

LikeLike

I just realised I spelled gem with a j. Please excuse my just woke up typo aha

LikeLiked by 1 person

Thanks so much for this useful write up! HSBC is closing down, so I’m looking for another bank to open an account with.

LikeLike

You’re welcome, glad you found it useful! Most of us are in the same boat in terms of HSBC’s wind down so it’s definitely good to start surveying early and comparing services across the other banks 🙂

LikeLike

[…] of the driving considerations for moving to Standard Chartered. But as I once discussed when I compared savings accounts across banks, Baiduri does have superior savings interest rates with their Multi-Tier and […]

LikeLiked by 1 person

hi can you nplease explain to me the flexi fixed deposit account?

I opened an account with SCB 7 yrs ago but Im already in the Philipines how can I get that money?

LikeLiked by 2 people

Hi KC, what do you mean by the flexi fixed deposit account – which bank and type of account are you referring to?

Since I don’t work for any of the banks (I’m just a regular customer like yourself), I would advise you call Standard Chartered Brunei at their hotline +673 265 8188. Perhaps they’d be able to arrange a telegraphic transfer of the money in your Brunei bank account to your Standard Chartered Philippines account 🙂 This may incur some charges though, so I do recommend you check with them over the phone. Based on my experience with telephone banking, they will ask you a series of identification and security questions to verify your identity – so it would help if you had a record of your old bank account number, etc. before you make the call.

Hope that helps!

LikeLiked by 1 person

[…] the interest/profit rates of almost all the accounts – the post is here which compares the interest rates of all savings accounts It’s still valid. And since I stopped blogging in 2015, I still get quite a decent […]

LikeLike